property tax assistance program montana

Ii under contract for deed. Property Tax Relief If you are low income a 100 disabled veteran or surviving spouse or had a large increase in your property taxes due to reappraisal you may qualify for tax assistance.

Imgur Com Investing Money Where To Invest Flow Chart

0 - 8505 0 - 11339 80.

. The taxpayer must live in their home for at least seven months out of the year and have incomes below 21262 for one eligible owner or below 28349 for a property with two eligible owners. Property Tax Assistance Program PTAP Application for Tax Year 2018. Apply by April 15.

Property tax assistance program -- fixed or limited income. Among its duties the PAD administers property tax assistance programs. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of assisting citizens with limited or fixed incomes.

The income limits in effect based on 2009 income are 19968 for single persons and 26624 for married couples or. Search Query Show Search. Assistance programs affect the property tax bill.

Montana Department of Revenue. Montana homeowners whose total income is below a certain limit can claim property tax assistance that reduces their property taxes by a percent multiplier from 20 to 70 depending on income. View or Pay Property Taxes.

You may use this form to apply for the Property Tax Assistance Program PTAP. Property Tax Assistance Program PTAP will reduce your tax obligation if you meet the following income guidelines. 2 The first 200000 in appraisal value of residential real property.

Assistance in Applying for PTAP. 21032 or less for a single person or 28043 or less for a married couple. Rule 4219401 - PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM 1 The property owner of record or the property owners agent must make application to the local department office to receive the PTAP benefit provided for in 15-6-305 MCA or the MDV.

Section 15-6-305 - Property tax assistance program - fixed or limited income. Form PPB-8 Property Tax Assistance. Single Person Married or Filing Head of Household Percent Reduction.

4 The property tax exemption under this section remains in effect as long as the qualifying income requirements are met and the property is the primary residence owned and occupied by the veteran or if the veteran is deceased by the veterans spouse and the spouse. This program applies solely to the first 200000 of the primary residences market value. The benefit only applies to the first 200000 of value of your primary residence.

13042- 21262 19845 - 28349 30. I owned by the applicant. PTAP is designed to assist citizens of Montana who are on a limited or fixed income.

Property Tax Assistance Program. The income ranges are updated each year for inflation. If you are already approved for the Property Tax Assistance Program you will not need to apply again.

Helena The Montana Department of Revenue wants to let property owners know about a change in state property tax assistance programs to make it easier for taxpayers to apply for reduced property taxes. Section 15-6-311 - Disabled veteran program. You may use this form to apply for the Property Tax Assistance Program PTAP.

You have to meet income and property ownershipoccupancy requirements every year. The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. PTAP provides this assistance to these.

4219401 PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. Property Tax Assistance Program Application Form PTAP Home Memphis Documents Posts Property Tax Assistance Program Application Form PTAP September 2 2021 by Montana Department of Revenue. Montana Individual Income Tax Resources.

Section 15-6-303 through 15-6-304 - Reserved. Flathead County Treasurer290 A North MainKalispell MT 59901. The home or mobile home on a foundation must be owned or under contract and the owner must have lived there for at least seven months during the preceding year.

1 The property owner of record or the property owners agent must make application to the local department office to receive the PTAP benefit provided for in 15-6-305 MCA or the MDV benefit provided for in 15-6. The primary residence must be the only residence for. Tax forms available from Department of Revenue.

To be eligible the property must be. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Property owners who already benefit from the Property Tax Assistance Program PTAP or Montana Disabled Veteran MDV program do not have to.

Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax rates on their homes. A is the owner and occupant of. 8506 - 13041 11340 - 19844 50.

This presentation gives an overview of the role the Montana Department of Revenue DOR through its Property Assessment Division PAD plays in maintaining the property tax record in each county of the state. Click here to learn about property the tax relief programs offered by the State of Montana. To be eligible for the program applicants must meet the requirements of 15-6-302.

2017 Income Guidelines for the Property Tax Assistance Program. Section 15-6-312 - Time period for property tax assistance. Property Tax Assistance Program.

3 A taxpayers primary residence is a dwelling in which the taxpayer can demonstrate they lived at least 7 months of the year for which the assistance is claimed. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. The reduction depends on.

Form PPB-8A Montana Disabled Veteran. Section 15-6-306 through 15-6-310 - Reserved. More about the Montana Form PTAP Other TY 2021.

If you are already approved for the Property Tax Assistance Program you will not need. Iii used as the applicants primary residence. For agricultural and timber parcels the only eligible land is the.

Section 15-6-302 - Property tax assistance - rulemaking. The Property Tax Assistance Program PTAP was created for property owners who need help paying off their taxes which can be quite high considering the amount of land that you can purchase in Montana. We last updated the Property Tax Assistance Program PTAP Application in February 2022 so this is the latest version of Form.

Tax Breaks For Montana Property Owners Inspect Montana

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Filing Taxes Income Tax

Montana Income Tax Information What You Need To Know On Mt Taxes

Did You Receive Your Property Appraisal Notice Here S What It Means And What You Can Do About It Missoula County Blog

Property Montana Department Of Revenue

Where S My Refund Montana H R Block

Montana Income Tax Information What You Need To Know On Mt Taxes

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest Rates

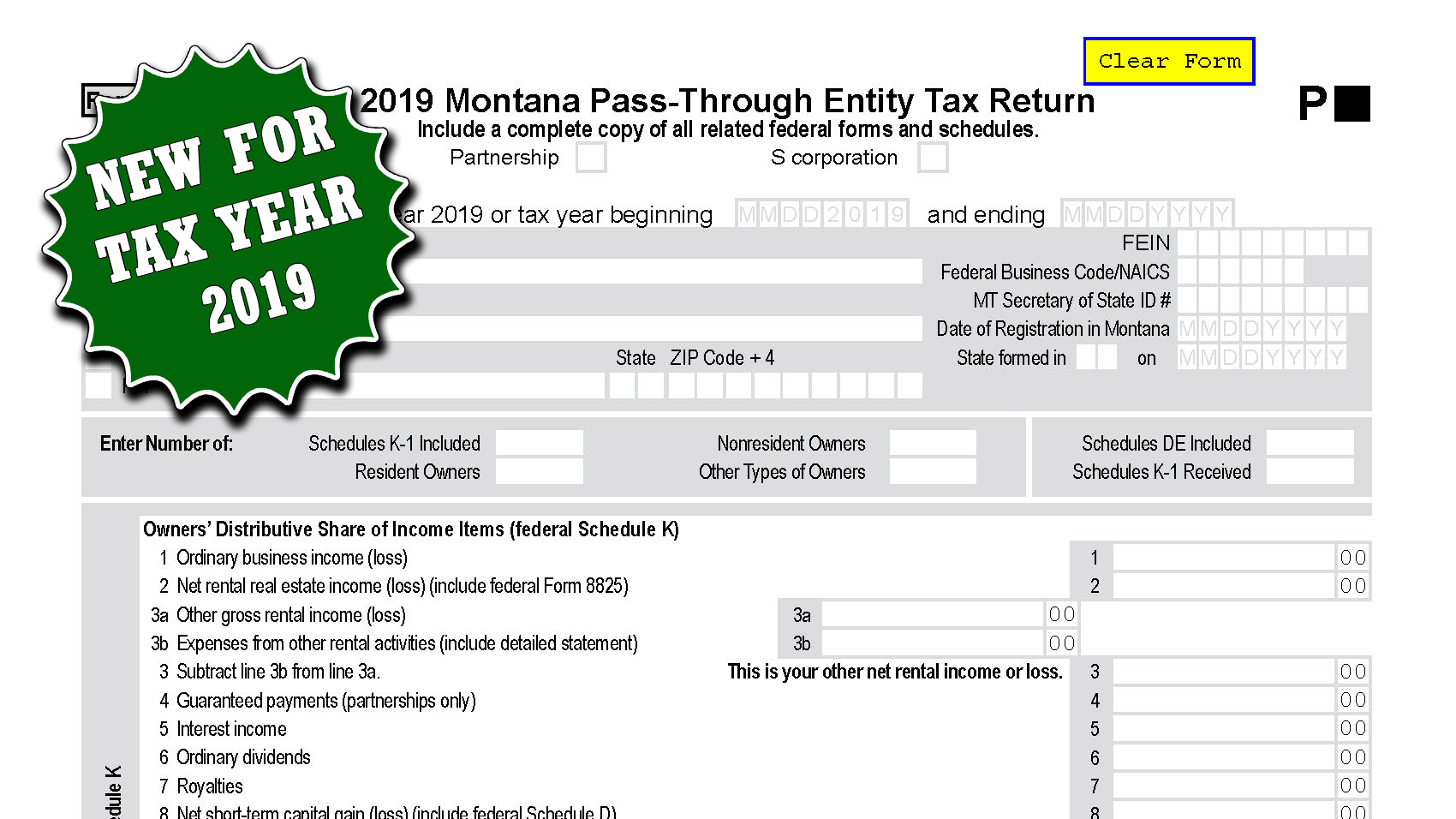

New For Tax Year 2019 Montana Pass Through Entity Tax Return Form Pte Montana Department Of Revenue

Tax Breaks For Montana Property Owners Inspect Montana

Icymi Campaign Posters Opposing 2 Cent Fuel Tax Prompt Complaint To Montana Cop Campaign Posters Gas Tax Campaign

The 10 Best States To Live In If You Want To Retire Early Early Retirement Health Insurance Life Insurance Facts

Montana Income Tax Mt State Tax Calculator Community Tax

Tax Relief Programs Montana Department Of Revenue

Ci 121 Montana S Big Property Tax Initiative Explained

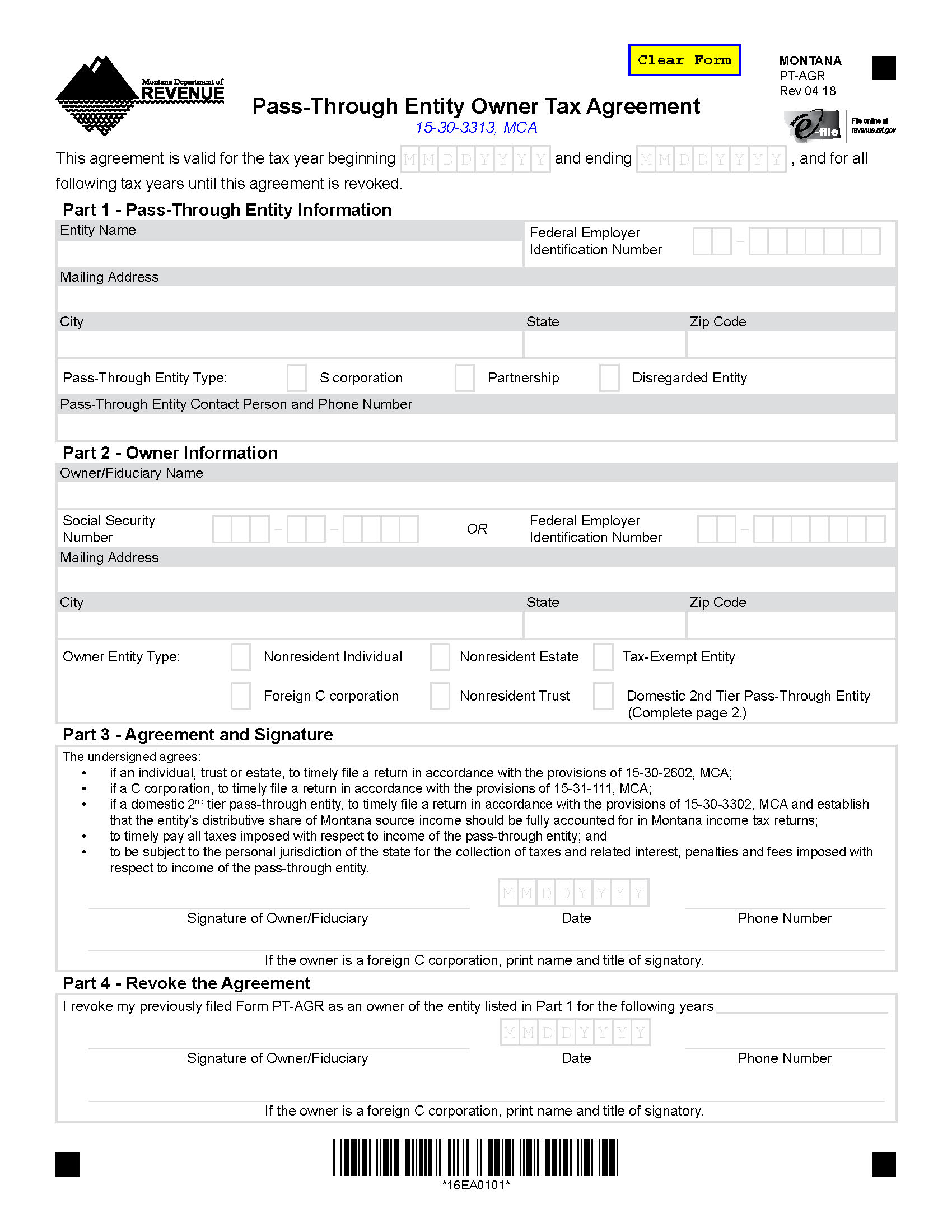

Filing For A Waiver From Pass Through Entity Withholding Montana Department Of Revenue

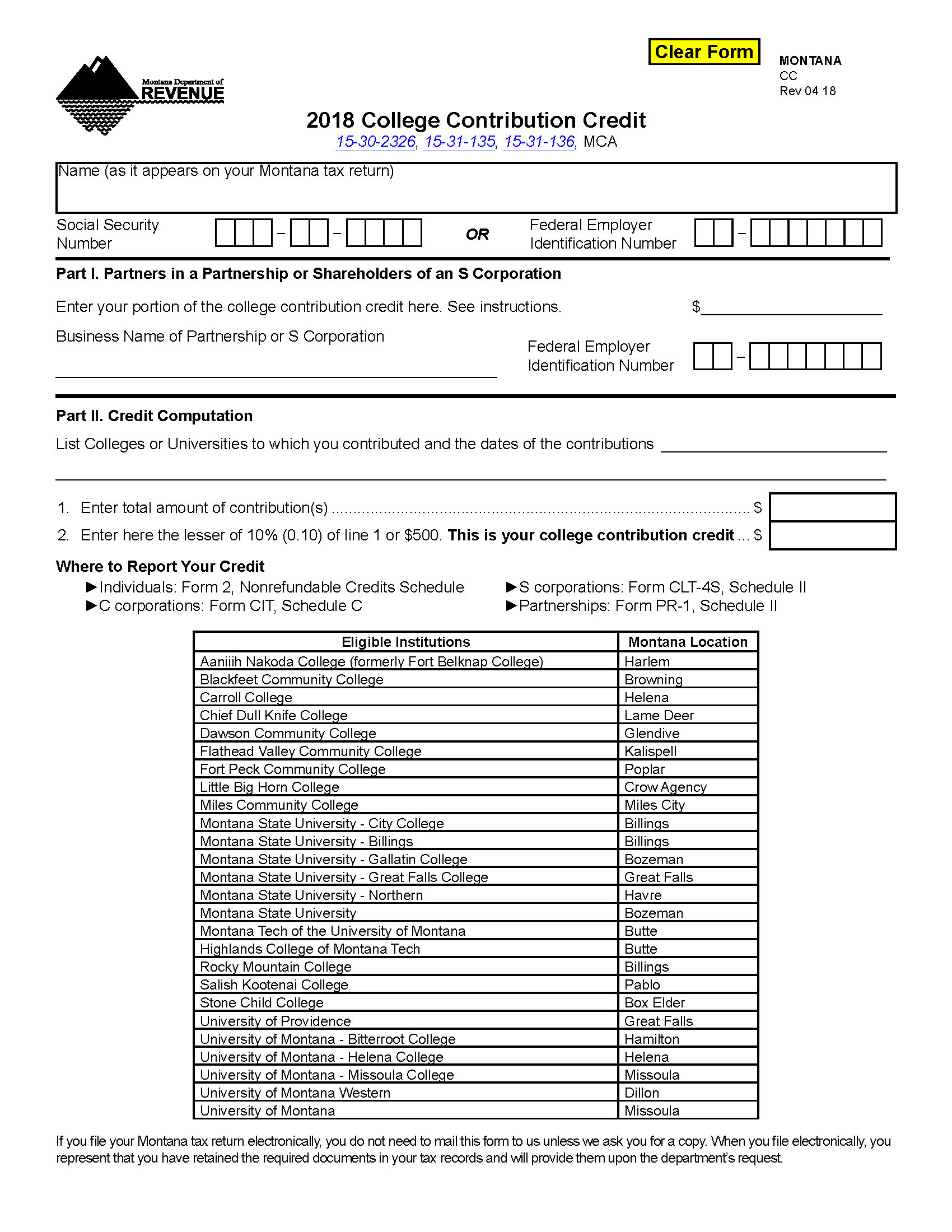

Changes To The College Contribution Credit Montana Department Of Revenue